The Startup Financing Catch-22TM

Are you starting to get frustrated by the Venture Capital Catch-22TM?

What is the Venture Capital Catch-22TM? Well, startups need capital to start, but both venture capitalists and angel investors really prefer to fund companies which already have traction (i.e., sales). This is one big reason why no one is funding you. Anything still at the concept stage is perceived as being simply too risky by investors.

The Guerrilla Startups Guide solves this problem for you by offering a veritable smörgåsbord of creative financing techniques to get your startup off the ground.

I began collecting creative financing techniques in the early-1980s for two important reasons:

1. Raising capital is by far the most unpleasant task an entrepreneur will ever have to perform.

2. As soon as you accept money from an investor, you become beholden to them and start to lose your autonomy.

Since I have an aversion to unpleasant tasks and loss of control, I began to research how elite and serial entrepreneurs were getting their companies out of the starting blocks without outside capital. In the early 1990s, an associate at the technology consulting firm where I was working suggested that I compile them into a book. It took a while to complete but in 1995 I started selling the Startup Guide online and the rest is, as they say, history

So, if you are the type of person who prefers to save time and money by learning from others as well as preserve his or her autonomy, invest in the Guide today. (If you’re not, you will still find this site a treasure trove of free information on the subject of raising capital.)

Important Lesson:

If you can’t see the value in learning quickly from others, beware of the fact that the marketplace will not reward you four times as much for taking four times as long to learn a lesson. In fact, it will punish you for taking far longer than was actually necessary. Odds are high that someone else will run with the same idea and leave you in their dust.

Successful business-people share two traits: they make decisions quickly and they move quickly. They don’t dawdle.

Don’t Waste Anymore Time

Order Now

1. Professional Version Startup Guide

The 290 page Startup Guide is normally $99.95. Today you can invest in the Guide in PDF (digital version) format readable with a free copy of Adobe Reader for only $79.95, includes Excel spreadsheets.

Here is an excerpt.

2. Professional Version Startup Guide + 1 Hour Telephone Consultation

Ever felt a desire to have a productive talk or brainstorming session with another entrepreneur with close to two decades of experience? Order the Package Deal today which includes the Guide in PDF and a completely confidential talk about anything pertaining to start-ups, financing, marketing, strategic alliances, public relations, or a host of other management issues. (Sorry, no legal, tax, or accounting advice is offered.) This option includes everything from the first option plus an hour of talk time to answer questions and provided feedback if requested.

Here is an excerpt.

To invest in the 1 Hour Package for only $149.95, click here:

What Does the Startup Guide Cover?

1. Knocking on doors in an effort to find someone willing to hear your elevator pitch or read your business plan and dealing with the disheartening rejection?

2. Starting your business using the eye-opening lessons you learned from America’s best entrepreneurs, gaining traction, and having investors show a genuine interest in funding you for faster growth?

Having tried it both ways, I know which option I prefer.

These are just some of the things the guide teaches you about getting your startup out of the starting block:

– How to apply the Do-able Deal Test to your idea

– Creating cash floats to gain the all-important traction

– Advanced cash flow engineering tactics

– How to quickly access and leverage trade credit

– How to get customers and clients to pay you up front

– How to fund or acquire various types of assets such as accounts receivable, inventory, equipment, and fixed overhead

– The psychology of attracting support from key players

– How serial entrepreneurs determine the do-ability of a startup idea so as not to waste time on undo-able ones

– How to design a business model that will enable you to launch without outside capital

– Many more actionable tricks that you can use immediately

And much much more that will help you to impress potential investors, partners, customers, and employees.

Many of the most successful companies operating today and in the past used these tactics to launch.

More Testimonials

The Startup Guide teaches you how to get your venture off the ground with little or no outside money. It does so by revealing the financing strategies used by entrepreneurial greats when investors weren’t available. Ironically, while the Guide tries to dissuade you from using outside money, the application of its strategies will actually make your venture all the more attractive to venture capitalists and angel investors.

– Wil Schroter, Founder GoBigNetwork

The Startup Guide is the best tool I’ve found yet for financing a new business!

– Catherine Austin Fitts, President of Solari, Inc., MBA (Wharton)

The Startup Guide has been an invaluable resource to me during the launch of Playscreen. It perfectly illustrates hard learned lessons that entrepreneurs would be well advised to pay attention to. In the midst of all the misinformation and hucksterism around starting a company the SSG is a valuable resource you should have if you are running or working at a startup company.

– William Volk, CEO & founder playscreen.com

This is the startup financing bible venture capitalists really don’t want you to know about. Use it to launch practically any startup without having to raise outside capital. A well-written book packed with loads of good information.

– Paul Kedrosky VC

Peter Ireland’s Startup Guide is a must read for any aspiring entrepreneur or business executive seeking to cost effectively start or expand their business when outside capital is hard to come by. The financing techniques used in his guide were invaluable when I was at an Inc. 500 software firm and remain as effective today in my latest self-funded company.

– Alan Blume, StartUpSelling, Inc. CEO, Inc. 500 alumnus (2 years)

This is the startup financing guide every entrepreneur must read. Peter provides a creative yet do-able approach to getting your startup off the ground. If you want investors you must first show that you know how to create positive cash flow.

– Gene Marks www.genemarks.com

Over the past 20 years Peter Ireland earned a well-deserved reputation as the go-to-guy for startup financing solutions. His startup financing guide teaches entrepreneurs the tricks and tactics employed by elite entrepreneurs to launch their startups when cash is scarce.

– Barry Moltz www.barrymoltz.com

The Startup Guide’s Origin

Second, when I managed a venture fund years later I realized that two types of people came to us for money. One group, the larger one by far, had nothing more than a business plan to show us. By then I understood that a business plan was about as objective and accurate as an ad on a dating site. The other and much smaller group came to us with actual proof of traction: invoices, purchase orders, and bank statements. They then explained that they needed more money to make a business already growing grow faster.

Who do you think got the money?

This latter experience just reinforced my belief that entrepreneurs, especially rookies, needed to know about entrepreneurial finance. So my search for creative solutions to lack of capital continues to this day.

By the way, over 21,600 copies have been sold as of Fall 2012.

Part 1: Raising Capital, The Bad News

Before Embarking on a Campaign to Raise Venture Capital Funding, You Should Look at Yourself Objectively and Honestly to Determine if You Even Qualify. Most People Don’t Stop to Do This.

Since the vast majority of capital hunters don’t qualify, you will, in most cases, end up wasting anywhere from 6 to 12 months of your life writing a business plan which will never be read and doing “dog & pony” shows for audiences who are at best only mildly curious or at worst engaged in “brainsucking” you for ideas.

Who Qualifies for Investor Capital Today?

* at least 2 other senior executives with experience in building wildly successful companies,

* a proprietary technology in a sector currently considered hot by the venture capital industry,

* a top-notch technical team,

* a target market at least one billion dollars in size,

* a minimum of one year of rising sales to blue chip customers.

It you don’t meet the above criteria venture capital funding won’t happen.

If your name is not synonymous in the minds of financiers with huge, almost obscene, profits, your plan will be accepted politely but never actually read beyond the “team” section.

If you haven’t made big money for investors and don’t have any close relatives running venture capital firms, you should read on.

Since angel investors in most cases hope to hand off their investments to venture capitalists after a few years, they are forced to follow pretty much the same criteria when it comes to making investment decisions.

The Three Dirty Little Secrets About Raising Outside Capital

Let me share with you three secrets about raising capital which almost no one else will.

* First, chasing outside capital is by far the most unpleasant and drawn-out ordeal experienced by entrepreneurs. It always seems to take forever. (For this reason, veteran entrepreneurs try to avoid raising outside capital at all costs.)

* Second, based on the fact that your typical early-stage venture capital firm invests in only one company out of every 500 business plans it reviews, your odds of succeeding are only 1:500. (If you are pursuing angel investors your odds improve to perhaps 1:100, although no one knows the numbers for certain.)

* Third, in about 50% of instances where an early stage company actually succeeds in raising venture capital, the founder is fired within the first year and kisses most of his or her stock good-bye. Even the Wall Street Journal pointed this out in a article by Barnaby Federer from 09/30/02:

The Startup Guide covers two dozen other reasons why no sane entrepreneur accepts venture capital other than as a last resort doomsday response.

The Funding Problem

Here’s what typically happens when a company needs to chase outside capital in order to commence or expand operations. After about 6 months one of three things occurs:

1. The lucky 1 in 100 or 500 finds investors.

2. Most die on the vine. In many cases, the wannabe entrepreneur simply abandons the project and moves on to something else. (As the joke goes, “That’s why God created ‘jobs’.”)

3. A savvy and tenacious tiny minority of entrepreneurs finally gets mad at having wasted so much time. Then it begins to figure out a creative way around the funding problem by focusing on creating cashflow with the resources and opportunities at hand, instead of continuing the futile quest for outside capital.

Necessity truly is the Mother of Invention.

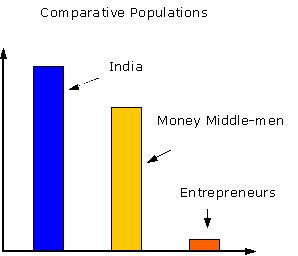

America’s Fastest Growing Industry?

This problem of capital scarcity for early stage companies is so prevalent that you may have begun to notice that there are literally thousands of people in the business of “helping” entrepreneurs raise money. At least that’s what they lead you to believe. They have taken their cue from the Gold Rush when the truly crafty business-people made money not from prospecting but from selling shovels and supplies to the prospectors. Likewise, today’s money-raising services have found a low risk means to separate the cash-starved entrepreneur from any money he or she may have left. They do so in many ways:

* Matching Services: We’ll match your project with one of our many accredited angel investors. Call now! Operators are standing by! Just $199 to register.

* Business Plan Services: We’ll write a business plan for you which will attract funding. Only $999.

* Finders: I can help you raise money for a fee…and, by the way, I require a retainer up-front.

* Money-Raising Bootcamps: Attend our weekend bootcamp for $1,195, and you’ll discover that it’s not what you know but who you know that counts when it comes to raising money.

My two personal favorites are:

* Online Business Plan Repositories: Post your b-plan on our site for 6 months. Only $59.

* Venture Capital Directories: VC’s are waiting to fund you! For just $49 you can buy our CD directory with 12,952,734 venture capital firms listed on it. (How these can sell in the age of Internet search engines is beyond me. PT Barnum was correct about a sucker being “born every minute”.)

* Do some digging into the new field of crowdfunding and you will discover that it doesn’t really improve matters all that much for entrepreneurs.

In a nutshell, most of these middle-man services don’t work in the majority of instances. This is also why they won’t tell you the Three Dirty Little Secrets of Raising Capital.

Lesson: put very little faith in these services and never pay up-front fees.

The Rodney Dangerfields of Entrepreneurship

Pretend for a moment that you are a venture capitalist or angel investor. Two founders visit you about separate deals. You ask them each what progress they have made in the 3 or 6 months that they have been working on their respective projects.

* One entrepreneur answers that he has been able to finish his business plan as well as find a means to generate cashflow which is being used to move the main project further along. Now he needs more money to fully capitalize on this developing opportunity.

* The other entrepreneur can only point to the “great” business plan that he’s polished to perfection over the past 6 months and the “great” opportunity lying before him.

Which entrepreneur would you be more impressed by if you were the investor? Back in the 1990s, I took a 4 year sabbatical from entrepreneurship to run a small business investment fund, so let me share my opinion. The former has shown that he is a doer; the latter has provided nothing in the way of evidence that he can create cashflow–any cashflow.

If you are not a recognized star when knocking on investor’s doors, you’ll quickly start to feel as if you “can’t get no respect”.

Lesson: cashflow wins far more respect from investors than the “great” business plan. If you are not an industry star you can begin to build your credibility up by finding a means of creating cashflow in your industry.

Real Entrepreneurship is About Cashflow Creation

It’s all about positive cashflow. If you can make it happen, you get respect and investors to fund you so that you can make even more.

At some point in the mid-1990s real entrepreneurship became subverted into merely writing a business plan, developing a Powerpoint presentation, scripting an “elevator pitch”, and then pestering disinterested or skeptical strangers for money. With the entrepreneurial bar thus lowered almost to the ground, seemingly everyone declared themselves an “entrepreneur” and tried to hop aboard the dotcom express.

However, real entrepreneurship is not about these things at all. It’s about making cashflow happen now.

Never forget that.

Repeat three times daily until the delusion goes away:

With cashflow I’m a somebody; without it I’m a nobody.

With cashflow I’m a somebody; without it I’m a nobody.

With cashflow I’m a somebody; without it I’m a nobody.

Fact: Successful entrepreneurs invest the same level of time and energy into creating cashflow during the first year that wannabes invest in polishing their business plans and offering them to complete strangers.

Let’s Summarize the First Half

Lesson 1: Money goes to entrepreneurs with proven track records as money makers for their backers.

Lesson 2: The other 499 capital chasers typically end up just wasting 6 to 12 months of time and effort on a capital raising campaign doomed from the very start.

Part 2: Raising Capital, The Good News

The Solution

There is no one guaranteed answer to the funding problem which all startups face. What is the solution, however, is having several dozen successful strategies for creating cash, or its equivalent, in order to be able to get your company out of the starting blocks.

This is precisely what the Startup Guide offers you. Dozens of financing strategies and tactics used by fast growth startups to launch.

If we look at the companies which qualify for those annual lists of the fastest growing companies, we see that over 95% were unfunded at start-up beyond a nominal injection of the entrepreneur’s own money (in most cases, less than $10k). Most didn’t even have a business plan. Why did this minority of unfunded entrepreneurs succeed while most start-ups seeking capital die on the vine or morph into something completely different—that is, something more do-able after 6 months?

To answer this question, let me use an analogy. Think of entrepreneurs as chefs. Some chefs are very rigid in their style requiring that a specific list of ingredients be delivered to them before they can begin cooking. This rigidity is fine so long as you are not too hungry and can wait for the required items to arrive. However, if you are hungry now and lack the cash to buy more groceries, you will need to be flexible and work with what you have.

Other chefs, the more flexible and entrepreneurial ones, will not wait for someone else to deliver a bag of groceries to them, but will instead immediately begin to search the pantry, refrigerator, and vegetable garden for what is available. They will then use the items at hand to create a feast.

It’s been said that true entrepreneurs are the artists of the business world. They create new businesses and products seemingly out of nothing. It’s awe inspiring to watch a true entrepreneur formulate an idea and then begin making it happen within hours rather than sitting around for months writing business plans and pestering strangers for money.

In a nutshell, the successful cash-strapped entrepreneur designs a transitional business model for the launch, which can be described as “Heads I win; tails I lose very little.” Once their concept has some degree of traction, they can then choose to talk to investors from a bargaining position of strength.

Once you have cashflow life becomes much simpler. Cashflow not only enables you to pay your bills but it places your company into the “stream of opportunities” that established businesses enjoy. Cashflow also earns you respect and gives you the ability to say, “No thanks!,” to those notoriously outrageous offers made by venture capitalists and sophisticated private investors.

Why Does It Work?

The Guide’s Start-up Model distils the lessons of America’s most successful start-up companies for you to use in your venture. You can use the model as a screen to evaluate your current strategy for viability. If it doesn’t pass the test, you can use the model to deconstruct it and formulate a new strategy.

The Guide contains dozens of tactics used by successful entrepreneurs to both launch without outside capital and retain control of their companies. It shares “war stories” which illustrate how entrepreneurs think and react to circumstances which would force most others to give up and look for a job.

The Guide is the next best thing to sitting down in person with a group of Inc 500 Fastest Growing Companies founders and having them share their secrets with you.

Some people need to learn the hard way, while others don’t have time to waste and prefer to learn from the mistakes of others. I belong to the latter group. Why should I make the same rookie mistakes as others, when I could instead learn from those who did it the right way before me?

How did you get to be so smart about startups?

It all comes down to three things: experience, experience, and more experience. I have personally launched six companies over the past 20 years. In addition, I have acted as an advisor or consultant to hundreds of other entrepreneurs over that time. Finally, although not an academic, I enjoy researching what makes startups successful and then teaching the lessons to others through the Guide or in live classes.

I was motivated to find a “better way” to launch and grow a company over its first year after doing my very first venture capital deal in 1987. It was akin to being mugged in a dark alley. There truly had to be a better way. So I began paying attention to what successful entrepreneurs were doing.

The Value Proposition to You

Reading the Startup Guide is akin to spending a week with the founders of successful fast growth companies. Imagine being able to pick their brains to learn how they formulated their tactics for fast start-up and growth.

Just think how much this knowledge would be worth to you. On average, it will help you to save 6 or more months of your life from being wasted going down dead ends in a futile pursuit of outside capital.

Would this knowledge be worth $500 to you? At the very least, if you are truly serious and not just a dreamer as many people are. It could even be worth $5000 to you. Or much more.

Some people need to make their own mistakes and learn the hard way. Others can’t afford to waste time and money and prefer to learn as much as possible from those who succeeded before them.

The Guide is for this latter group.

Executive Decision Time

Think of the Startup Guide as an entrepreneurial insurance policy which will ensure that you don’t waste the next 6 to 12 months of your life.

So ask yourself:

How much are the next six months of my life worth? Can I afford to waste them on what may turn out to be a dead end startup strategy?

In a Nutshell

To recap, the benefits of this manual for your business are:

* It will teach you how to think like a savvy veteran entrepreneur who focuses on cashflow creation rather than on begging for money from strangers.

* It can drastically reduce the amount of capital needed to launch.

* It can help a company begin to generate cashflow before any funding occurs.

* In some cases, it can eliminate altogether the need for outside capital.

Discovering and using any of the lessons contained in the Guide will set you as much as a year ahead of other start-ups.

Cashflow = Respect from Investors

And if you are still committed to raising outside capital because you positively absolutely need a huge sum of capital to build that new state-of-the-art atomic-powered widget factory, you will still benefit from the Guide because:

* Cashflow–any cashflow–earns respect from investors, lenders, customers, suppliers, and even your Aunt Mabel. Positive cashflow attracts equity capital from investors.

* Cashflow will place you in a stronger bargaining position with potential investors since it will allow you to walk away from a bad deal. Pre-deal cashflow equals power. Power for you.

* Cashflow will give your company a higher valuation which in turn will allow you to hold onto more of your equity if a financing deal is done later.

If you are truly committed to building your business then do everything you can today to achieve this goal.

If you’re a realist you will try the Guide. Dreamers will continue to believe that other entrepreneurs don’t have anything to teach them and that it’s all about writing that “great” business plan which will miraculously convince people to throw money at an unknown.

Don’t kid yourself.

So ask yourself, in 3 months from now do I want to:

* still be polishing my business plan and chasing investors with nothing to show for my efforts, or

* do I want to have an operating company with positive cashflow?

The decision is yours. (If you decide not to invest in the Guide at this time, please bookmark this page for later reference.)

As I am fond of saying, entrepreneurship is like a 25-level computer game. If your startup knowledge is limited to “I’ll write a business plan and hope that some kind stranger funds me,” you’re stuck at level 1. By investing in the Startup Guide today, you can be up at level 20 or better within 48 hours or however long it takes you to read its 290 pages.

Strongly agree with your statements. I have challenging circumstances with my start up and can’t readily see how your approach could apply, so would appreciate your insights prior to determine whether I ought to purchase the Guide. Business entails purchase of the license for a proven technology/equipment already operational and being sold in Japan. Business will contract manufacture, deploy and sell these systems in US market. My strategy is to acquire a pilot plant because most of the federal and market customer opptys require viable and operational equipment – not just the concept of the system. Therefore, I must have a system in country, up and running… the price tag for equipment acquisition, establishing the pilot facility, and testing performance and quality of revenue generating co-products (this machine converts waste and materials to value-added products and energy) is $1.1million. These tests of the equipment and co-products are absolutely necessary in order to verify appropriate market outlets and obtain data required to consummate sales. I need $100,000 to stay alive, travel to Japan to have my engineer validate the system while I validate the licensor and negotiate the terms of the license, all the while progressing market(s) development while chasing that elusive $1.1mill. Any thoughts? Thanks.

I’m a third generation painter. I started my company at the age of 22. I worked every day even through 08″. Bringing in a half a million just in the books. That was before I wanted to start flipping with my personal dr that stole $200 thousand dollars of my own personal money. It’s a long story how she got away of it. All that business debt was on my personal credit bc of my dad telling me to be a sole proprietor. What made it worse was not working for two years of becoming majorly depressed losing everything I built then having a TI A stroke at the age of 34 and other health issues.it was kind of a blessing in disguise’s. Open my eyes and taught me how to become better . used to get all my work from the mouth but after three years things change . The new word-of-mouth was social media and when I came back to work I poured all my money into that . Now I have a opportunity better than before to work for big general contractors . With no capital makes it very tough and with my personal credit not being in the 800 club anymore made it even more difficult I can show you anything you need to see and willing to work any kind of deal to get me back in full force of working. I know my business plan. I know it very well I don’t have the right down . I am good on all sides of the business with marketing, sales , hard labor and knowledge. I don’t need to start over I just need help because I was taking a vantage of some corrupt people .I thank you for your time

My name is Ken and my number is 2196138911